For Non-Resident Indians (NRIs), selling property in India involves not just adhering to capital gains tax but also complying with TDS for NRI on sale of property requirements. These regulations ensure proper tax collection and prevent evasion, but they can also be complex for NRIs unfamiliar with the Indian taxation system. This blog explores the various forms of TDS applicable to property sales by NRIs, their implications, and strategies for compliance.

How TDS Applies to Property Sales by NRIs

When an NRI sells property in India, the buyer is obligated to deduct TDS before transferring the payment. Here’s a detailed look at how it works:

- For Short-Term Capital Gains (STCG): If the property is sold within 24 months of acquisition, the gains are categorized as STCG. The TDS rate for STCG is 30%, as it aligns with the applicable income tax slab rate for NRIs.

- For Long-Term Capital Gains (LTCG): If the property is held for more than 24 months, the gains are categorized as LTCG. The TDS rate for LTCG is 20%, regardless of the tax rate applied.

Who is Responsible for Deducting TDS?

The responsibility for deducting and depositing TDS lies with the buyer of the property. Key steps include:

- Obtaining a TAN (Tax Deduction Account Number): The buyer must acquire a TAN, as it is required to deposit TDS with the Income Tax Department.

- Filing TDS Returns: After deducting TDS, the buyer must file the details through Form 27Q and pay the deducted amount using an e-challan by the 7th day of the following month.

- Issuing Form 16A: Once TDS is filed, the buyer provides Form 16A to the NRI seller, which is crucial for claiming TDS credit during tax filing.

Threshold Limits and Section 195

Under Section 195 of the Income Tax Act, there is no minimum threshold for deducting TDS on payments made to NRIs. Whether the sale amount is large or small, TDS must be deducted if the income is taxable in India.

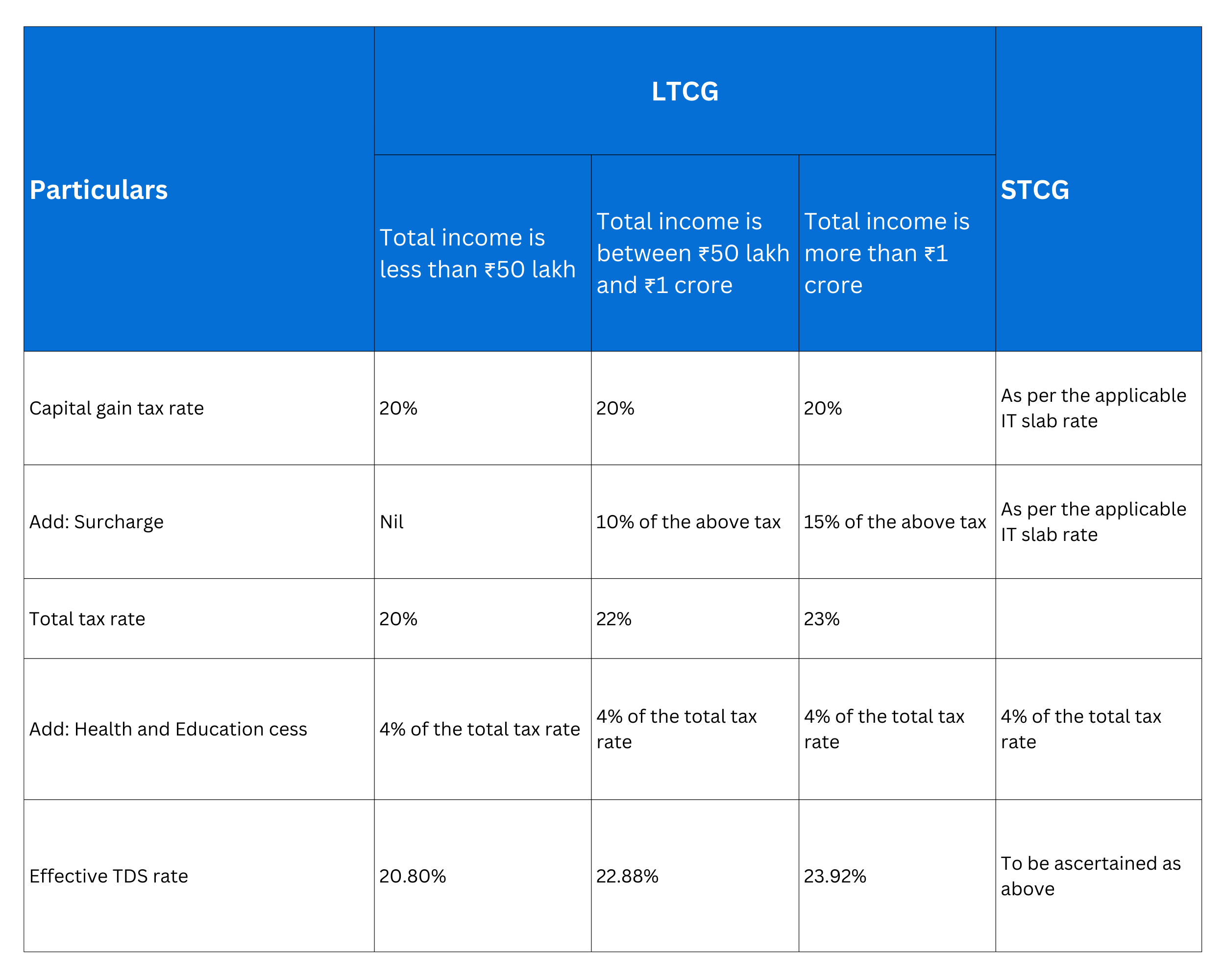

The table below summarises the effective rate of TDS for different income levels of NRIs in India and the type of capital gains.

Consequences of Non-Compliance

Failing to deduct or deposit TDS can have severe repercussions:

- The buyer becomes liable to pay the TDS amount along with penalties and interest.

- The seller’s ability to repatriate funds to foreign accounts is hindered.

- Legal actions, including prosecution, may be initiated if misrepresentation of residency status or tax evasion is detected.

How NRIs Can Save Taxes While Selling Property

NRIs can reduce their tax liabilities by leveraging exemptions under the Income Tax Act:

- Exemption under Section 54: Reinvest capital gains from the sale of a residential property into another residential property in India within specified timeframes to claim tax exemptions.

- Exemption under Section 54EC: Invest in specified government-backed bonds, such as NHAI or REC bonds, within six months of the sale to defer or reduce capital gains tax.

- Lower TDS Deduction (Form 13): File Form 13 under Section 197 to request a reduced or nil TDS deduction, minimizing upfront tax payments and avoiding long refund wait times.

For more details, refer to Essential Tax Guidance for NRIs Selling Property in India.

Navigating Capital Gains Tax

Understanding capital gains tax is crucial for NRIs selling property in India. Accurately determining whether the gains are short-term or long-term impacts the applicable TDS rate and available exemptions. For long-term capital gains (LTCG), NRIs now have two options: opting for a flat 12.5% tax rate without indexation for properties registered after July 2024, or the traditional 20% tax rate with indexation for properties registered before this date. These choices significantly influence your tax liability. For detailed insights into capital gains tax, read Capital Gains Tax for NRIs Selling Property in India.

Key Takeaways for NRIs Selling Property

- Understand TDS Rates: Be aware of the applicable TDS rates for both short-term and long-term capital gains.

- Obtain Relevant Certificates: Apply for a TAN (buyer) and a lower TDS certificate (seller) to streamline the process.

- Plan for Exemptions: Utilize exemptions under Sections 54 and 54EC to minimize tax liability.

- Comply with Documentation: Ensure all necessary forms, such as Form 16A and Form 27Q, are filed to avoid complications.

How Brivan Consultants Can Help

Navigating the TDS requirements and tax implications of property sales in India can be daunting for NRIs. At Brivan Consultants, we provide end-to-end assistance, ensuring:

- Accurate tax calculations and compliance.

- Guidance on filing for lower TDS certificates.

- Assistance with documentation and regulatory procedures.

- Tailored advice to maximize financial returns.

Let us handle the complexities so you can focus on your priorities. Contact Brivan Consultants today for expert support with your property sale.

Conclusion

Selling property in India as an NRI involves navigating various forms of TDS for NRI on sale of property, tax obligations, and compliance requirements. By understanding the applicable rules, leveraging available exemptions, and seeking professional guidance, NRIs can ensure a seamless and financially optimized property sale experience.